Error: Contact form not found.

Key Takeaways

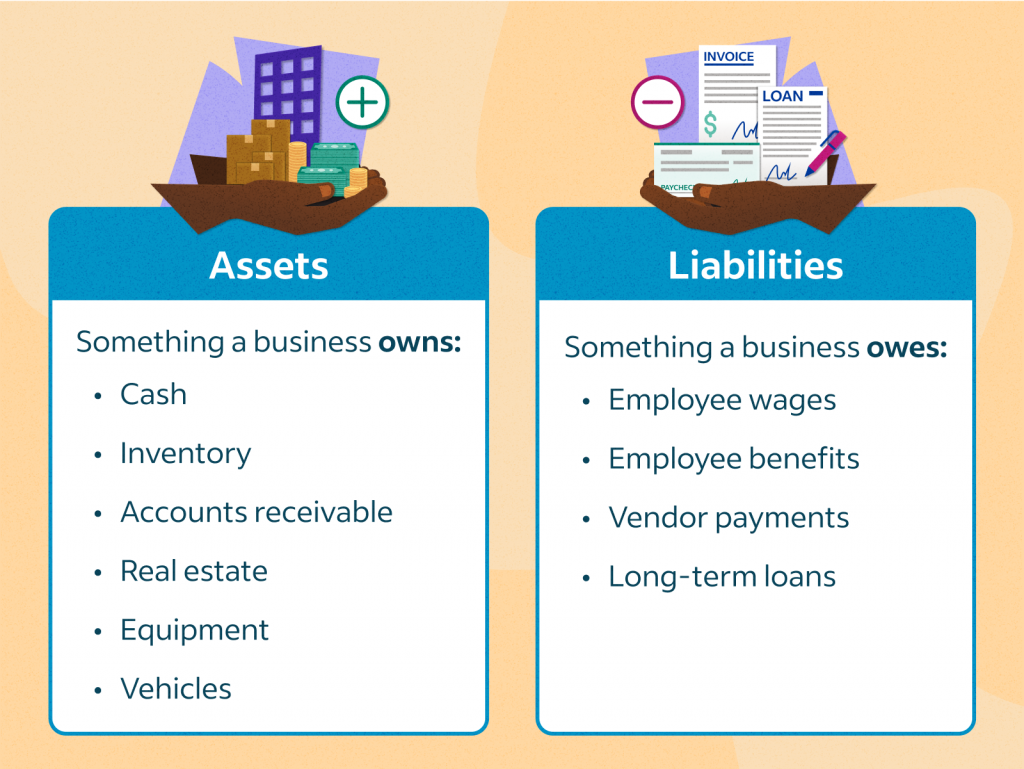

- An asset is a resource that is expected to provide a future benefit to its owner.

- In the case of businesses, assets are reported on the company’s balance sheet.

- An asset may generate cash flow, reduce expenses, or improve sales, and it may be either tangible (like a piece of machinery) or intangible (like a copyright).

- For accounting purposes, assets are commonly classified as current, fixed, financial, or intangible.

IFRS (International Financial Reporting Standards), the most widely used financial reporting system, defines: “An asset is a present economic resource controlled by the entity as a result of past events.[5] An economic resource is a right that has the potential to produce economic benefits.”[6]

Understanding liabilities

When you hear “liabilities,” you might think of passive income. However, while both passive income and liabilities are crucial financial concepts, they are fundamentally different.

We have already explained passive income here.

Knowing what liabilities are is essential because they can significantly affect your financial health and your business’s viability. Liabilities are debts you owe to others—be it individuals, companies, or governments.

A liability is a debt or an obligation. If you own a car and still have an outstanding loan on it, the bank is your creditor. In this case, the car represents a liability.

If you borrow money to pay for something like a house or land, the lender becomes your creditor, and the property becomes your liability. If you have a job that pays hourly but doesn’t cover all your monthly expenses, those unpaid expenses are still considered debts, as they will eventually be settled through your salary or assets.

Assets and liabilities are two sides of the same coin. Both represent the value of an asset but in different ways. Assets are items you own that have value, while liabilities are what you owe to others.

How do assets generate income?

You’ve probably heard the phrase “make your money work for you,” but what does that really mean? And how can you apply this principle to build wealth and financial security?

To understand how an asset generates income, you need to know its characteristics.

Characteristics of assets

In business, especially in accounting, specific terms describe asset characteristics:

-

- Current Assets

-

- Fixed Assets

I’ll detail this classification later in this article, but for now, let’s look at it from a personal finance perspective.

The income an asset generates depends on two factors: time and market conditions, and whether it provides constant income or is valuable due to its utility.

Time and market conditions

For example, if you own a rental apartment, your income will increase steadily over the years. In a few years, you might find that your apartment’s value has increased, allowing you to sell it at a profit. This profit would result from favorable market conditions.

On the other hand, if you own stock in a dividend-paying company and these dividends increase yearly, your income will also grow consistently. Similarly, the stock’s value may rise due to market conditions.

A real-life example

Imagine you had invested $1,000 in Apple when it went public in 1980. At that time, Apple had sales of about $2 million and only a few thousand employees. Today, Apple is one of the world’s most valuable companies, and if you held onto that stock, it would now be worth over $1 million!

Assets that don’t generate income but are valuable

An asset that doesn’t generate direct income could be a piece of art. It doesn’t bring in money, but it adds value to your home and makes it feel more personal.

Examples of personal finance assets include:

-

- A house

-

- Land you own

-

- A car

-

- A bank account

-

- A profitable business you own shares in

-

- Stock market investments

-

- Bonds and government securities

-

- Patents or copyrights

-

- Your education

-

- Valuables like jewelry, porcelain collections, comic book collections, etc.

-

- Talents like singing or playing an instrument.

Assets in family finances

If you’re planning to get married or start a family, consider how your personal assets will impact your collective financial situation.

Many couples combine their personal assets to work together as a unit. Personal assets provide a safety net for your family in emergencies and allow you to seize opportunities that improve your family’s quality of life.

It’s crucial to know how much money each type of asset brings in so you can make wise decisions about how to use them best.

Having a supportive team you trust—your family—can make all the difference. If you have a loving family that believes in you and your dreams, show your appreciation by taking care of the family’s assets.

Business perspective

A business you own is an asset, but it also comprises assets that don’t belong directly to you.

In business, assets are classified as:

-

- Fixed Assets

-

- Current Assets

Fixed Assets

Fixed assets are long-term investments intended for use for more than a year, such as land, buildings, equipment, and machinery. These are often called non-current assets.

Why a company needs fixed assets

Fixed assets are essential because they help a business generate income without using working capital or other current assets. Companies relying solely on current assets may struggle during economic downturns. Fixed assets allow businesses to operate efficiently and keep up with consumer demands, even in tough economic times.

Current Assets

Current assets can quickly be converted into cash, such as cash itself, bank accounts, marketable securities, inventory, and receivables.

Current assets are crucial for meeting short-term obligations and assessing a company’s liquidity.

Intangible assets

An intangible asset is an asset that lacks physical substance. Examples are patents, copyright, franchises, goodwill, trademarks, and trade names, as well as any form of digital asset such as software. This is in contrast to physical assets (machinery, buildings, etc.) and financial assets (government securities, etc.). Intangible assets are usually very difficult to value.

Total Assets

Total assets are the sum of all a company’s assets (current + fixed). They indicate a company’s total financial strength and available funds.

Personal asset management tips

When planning your life, consider what assets you have to help achieve your goals.

For example, cars are assets because they help you travel but can be costly to maintain. If the maintenance costs outweigh their utility, selling them might be wise to focus on other financial goals.

The same applies to any asset—houses, jewelry, art, even clothes with sentimental value. Ensure every asset has a purpose and helps you achieve your life goals.

FAQ: ASSETS

An asset is a resource with economic value that an individual, a company, or a country owns or controls with the expectation that it will provide a future benefit.

Yaropolk Dabrowski is a distinguished energy investing editor and a prominent expert in financial topics, renowned for his keen insights and analytical approach to the complex intersections of energy markets and investment strategies. With over a decade of experience in the financial sector, Yaropolk has established himself as a thought leader, guiding investors through the intricacies of sustainable energy investments and the impact of global market trends. His expertise spans across diverse areas, including renewable energy, oil and gas, and emerging technologies, enabling him to provide nuanced perspectives that resonate within the financial community.

Recognized for his contributions to top-tier publications, including Forbes, Yaropolk’s writing blends rigorous research with accessible language, making him a sought-after commentator on financial developments. His collaborative efforts with leading investment firms and industry experts further cement his reputation as a trusted resource for investors looking to navigate the dynamic landscape of energy investment. Beyond his editorial work, Yaropolk is dedicated to educating the next generation of investors, advocating for responsible and sustainable investing practices that prioritize long-term growth and environmental stewardship.